Trading cryptocurrency can be done in a variety of ways. The most well-known are individuals that day trade on the cryptocurrency market. Day trading needs a high level of competence, while other tactics don’t.

One of these tactics that doesn’t necessitate such advanced trading abilities is cryptocurrency arbitrage trading. However, it is not “simple” and does require some understanding of the cryptocurrency markets. Then, how does cryptocurrency arbitrage trading operate?

What Is Arbitrage Trading in Crypto

Table of Contents

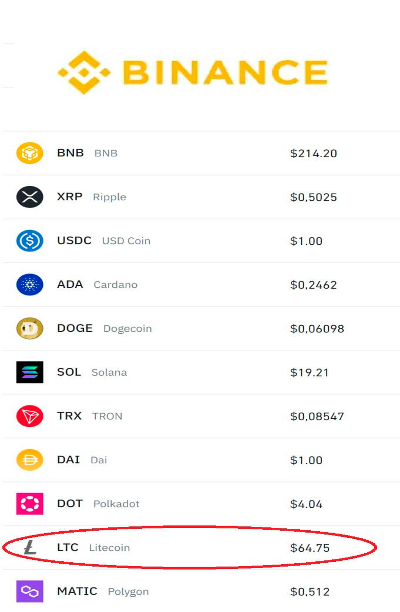

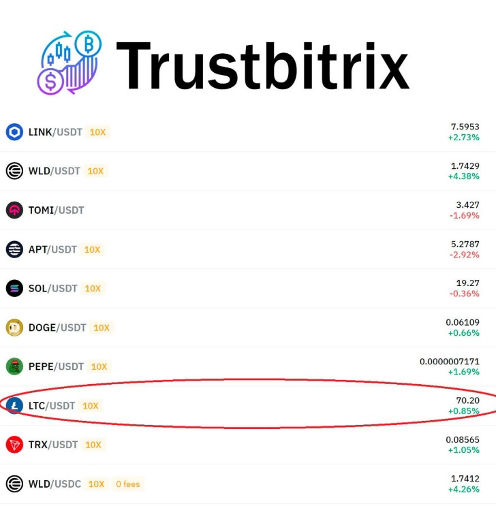

You might have observed that the price of a certain crypto is different on each exchange if you visit two or more at the same time. As an alternative, the price on one exchange is either higher or lower than the other.

Every market, whether it is for stocks, ETFs, commodities, or metals, exhibits this behavior. It is also prevalent in the cryptocurrency market, which is why crypto arbitrage trading has emerged.

A cryptocurrency trading method known as crypto arbitrage trading is buying and selling crypto assets while profiting from the price discrepancy between them on competing exchanges.

Anyone able to purchase and sell crypto assets on exchanges such as Trustbity.com can utilize the arbitrage tactic to benefit. Additionally, it often involves modest risk and little to no trading expertise.

How Does Arbitrage Trading in Cryptocurrencies Work

Arbitrage trading entails purchasing and selling digital assets between exchanges. In essence, you buy a crypto asset on Exchange A, where it is cheaper, and sell it on Exchange B, where it is slightly more expensive. Take a look at the images below to understand this better.

However, keep in mind that because of how unpredictable the cryptocurrency market is, the trade must be completed very instantly to avoid further price changes. As you will see in a moment, this might not be an issue in various types of arbitrage trading.

However, the volatility isn’t all bad because it gives the cryptocurrency market more opportunity for arbitrage trading than any other market.

Different Crypto Arbitrage Trading Types

Depending on the parties involved and how the arbitrage is conducted, there are different types of crypto arbitrage.

Inter-Exchange Arbitrage

Simply buy from one exchange and sell on another in this sort of arbitrage trading. There are just two exchanges.

It is impracticable to purchase assets on one exchange and then move them to another exchange to sell them since this kind of arbitrage trading depends on the real-time values of assets.

You can steer clear of this as well as transaction fees by buying and selling the asset at the same time. If you have assets listed on both markets, you can do this.

Spatial Arbitrage

This style of arbitrage trading takes advantage of price differences for an asset based on the distance between each exchange. Except the spatial component, it resembles inter-exchange arbitrage exceptionally closely.

Disparities in the demand for an asset are one element that fuels geographic arbitrage. For instance, if you reside in a nation where there is a strong demand for a certain crypto coin you can buy from an exchange situated in a nation where there is a lower demand for the asset and sell on regional markets there.

You will immediately profit from this because the increasing demand will increase the value of the crypto coin. Although this sounds like inter-exchange arbitrage, you can buy from one exchange and manually transfer to the other to sell for a profit because you don’t have to buy and sell based on real-time prices.

- Advantages Of Crypto Arbitrage Trading

- Trading method with minimal experience and low-risk

- Both low and high volatility can be achieved

- Most arbitrage trades don’t include a lot of fees

Conclusion

If done correctly, cryptocurrency arbitrage trading on sites such as Trustbity.com may be advantageous. Compared to day trading, for example, which includes trading actual market moves, it also carries very little to no risk.Any of the arbitrage trading strategies mentioned above are worth considering if you have the necessary assets to trade and satisfy all other requirements.